The goal of benchmark reports is to find big-picture trends that show not only where a sector has been, but also where it’s going.

Looking back is always easier than forecasting projections, and that’s especially true during an unprecedented global pandemic. In our 2020 Food Bank Benchmark Report, the big story for 2019 is a return to normalcy before the onset of COVID-19.

A variety of factors – changes to the tax code, a government shutdown and concerns about a slowing economy – made 2018 a tough year for many food banks. Thankfully, 2019 proved to be a rebound year for charitable giving metrics with a 2.2% year-over-year (YOY) increase for food banks. When we isolate direct-response gifts under $10,000, we see a 6.5% increase YOY.

This YOY food bank revenue exceeds the nonprofit industry averages in the Fundraising Effectiveness Project’s 2019 report (1.4% decrease in revenue) and Blackbaud Institute’s 2019 Charitable Giving Report (1.0% increase in revenue).

Unlike animal welfare organizations, where YOY revenue and donors remain relatively stable, disasters can have a dramatic impact on food banks. Given the extraordinary events of the COVID-19 pandemic, we also chose to take an extra look at disaster donors in this year’s report.

When reviewing the data for 2017, we see numbers well above the surrounding years. That’s because 2017 was a year full of disasters in the U.S. – three major hurricanes (Harvey, Irma and Maria) and more than a dozen wildfires throughout California (including the massive Thomas Fire). Those disasters skewed the revenue and number of new donors for numerous food banks.

Our clients often ask questions like, “How does our organization’s performance look when compared to other food banks?” and “How does charitable giving to food banks look year-over-year?” RKD Group’s annual Food Bank Benchmark Report was developed to help provide answers.

The 2020 Food Bank Benchmark Report contains full-file data from 64 RKD food bank clients across the United States from Jan. 1, 2019 to Dec. 31, 2019.

The data includes overall program metrics like total revenue, active donors, new donors, retention rate, average gift size and number of gifts.

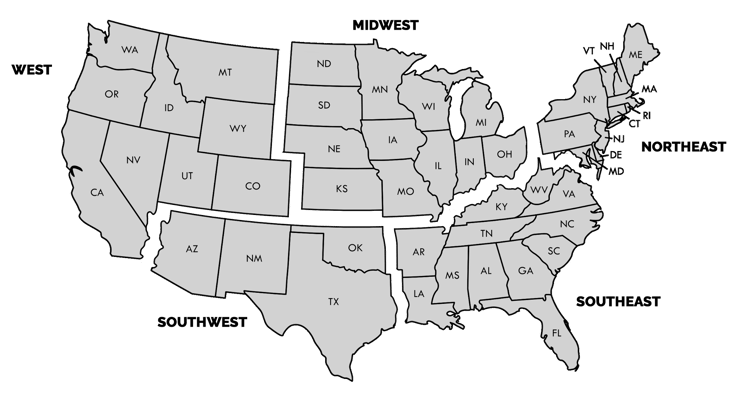

We’ve broken this data out into five regions across the U.S.: West, Southwest, Midwest, Northeast and Southeast. We’ve also categorized the data by organization size (determined by 0-12-month active donor file): Large, Mid, Small and Emerging.

Food banks saw a 2.2% year-over-year (YOY) increase in giving for 2019. When we take out revenue from donors whose highest previous contribution (HPC) is over $10,000, giving increased by 6.5%.

But looking at data in a one-year window doesn’t tell the full story. For example, we know 2018 proved to be a difficult year for many food banks, especially for year-end giving.

So, let’s zoom out a bit for a wider view.

Across a five-year span, total revenue for food banks has gone up 25.0% since 2015. In the same time frame, revenue under $10,000 has increased 19.8%.

The total number of active donors remained flat YOY, increasing by 0.3%. But, when compared to 2015, active food bank donors have declined by 7.4%.

Retention has held steady between 56% and 57% since 2015, with a big drop to 46% in 2018. We can attribute that to the second year of new disaster donors whose first gift came in 2017.

Clearly, retention is not the reason for the decline in active donors. We can turn to acquisition to understand more. The number of new and reactivated food bank donors increased by 4.7% YOY, but acquisition is down 9.2% overall from 2015.

How are food banks bringing in more revenue with fewer donors? Bigger average gifts and more frequent gifts.

The average gift size for food banks increased 4.6% YOY and is up 18.8% since 2015. Gift frequency also went up 1.6% YOY and is up 8.2% since 2015.

These five-year trends in revenue and donors reflect broad industry trends of fewer donors who are giving more.

The FEP report showed an 18.3% increase in revenue and a 1.4% drop in donors from 2015 to 2019. The CCS Philanthropic Landscape 2019 report shows a 3.6% revenue increase from 2014 to 2018, while noting widespread declines in the number of households giving since 2000.

Large food banks had a terrific 2019, with gains across the board in all metrics. These 16 food banks have 10,000-plus donors.

Mid-sized food banks also had a strong 2019, albeit with small declines in the number of donors. These 19 food banks have 5,000-9,999 donors.

Small food banks saw new donors and revenue increase, with slight drops in three categories. These 22 food banks have 2,000-4,999 donors.

Finally, emerging food banks saw all metrics increase. These 7 food banks have under 2,000 donors.

Food banks in the West region had a terrific 2019, with gains across the board in all metrics. (Note: This region was in Year 3 of the 2017 wildfire disaster cycle. In Year 3, percentages bounce back up to account for a return to pre-disaster trends.) These 13 food banks are located throughout 9 states in the West.

Similarly, food banks in the Southwest region had a very strong 2019, with gains in all metrics. (Note: This region was in Year 3 of the 2017 Hurricane Harvey disaster cycle. In Year 3, percentages typically bounce back up to account for a return to pre-disaster trends.) These 5 food banks are located throughout 4 states in the Southwest.

Moving to the middle of the U.S., food banks in the Midwest region also had a strong 2019. These 19 food banks are located throughout 12 states in the Midwest.

Food banks in the Northeast region had a mixed bag in 2019. These 7 food banks are located throughout 11 states in the Northeast.

Food banks in the Southeast region saw declines in nearly every metric in 2019. (Note: This region was in Year 2 of the 2018 Hurricane Florence disaster cycle. In Year 2, we typically see declines in revenue and active donors as the file begins to normalize.) These 20 food banks are located throughout 12 states in the Southeast.